How To Take Medicare From Mess To Modern [1]

By Greg Scandlen [2]

The sad irony is that the law creating health savings accounts extended them to everyone in America, except those on Medicare.

Social Security and Medicare are the two great pillars of America’s commitment to seniors’ well-being. Although both are troubled and have promised more than they can ever deliver, Medicare is by far the greater challenge.

Social Security is a pretty simple program. People pay in when they are working and the government sends them monthly checks (or electronic transfers) after they have retired. It is just a matter of moving money around, something the federal government is pretty good at.

Medicare is vastly more complicated. Start with the benefit design. It is still based on the old Blue Cross Blue Shield model from 1965, with Part A (hospitalization), Part B (physician and outpatient), and Part D (prescription drugs). Each has a different premium arrangement, different deductibles, coinsurance levels, and limits on benefits. Most people also have some form of supplemental coverage, either from their employer, Medicaid, or a private Medigap plan.

Medicare explains some of these differences [3] for the year 2017:

Part A

- No premium for people who paid into the program for 40 quarters (ten years) or more. For people who paid for 30-39 quarters the monthly premium is $227, or for fewer than 30 quarters it is $413.

- Deductible of $1,316 per year.

- Coinsurance: $0 for the first 60 days, $329 per day for the next 30 days, $658 per day for an additional 60 days over the course of your lifetime, full payment per day after that.

Part B

- Premium of $109 per month for most people on Social Security, but $134 per month or higher depending on income.

- Deductible of $183 per year.

- Coinsurance of 20 percent without limit.

Part D

There is no way to tell what is available until one goes online and enters his ZIP code and current drugs or checks the “Medicare and You” booklet [4] Medicare sends out annually. In my state (Pennsylvania) there are 23 plans offered with monthly premiums ranging from $170.60 to $14.60 and deductibles from $400 to $0 with additional coinsurance and copayment levels.

Plus, of course, there is Part C (Medicare Advantage), which replaces Parts A and B. In my state there is a choice of 147 different plans from 15 different insurance companies. The plans are all HMOs or PPOs with premiums ranging from $293 per month to $0, and are offered in select counties. They don’t usually have deductibles but they do have varying coinsurance and copayments based on whether the service is primary or specialist care, chemotherapy drugs, Part B drugs, home health care, or medical equipment. These plans likely limit the choice of providers, sometimes drastically.

Then, finally, there are the Medigap plans designed to pay the deductibles and copayments of regular Medicare. There are ten different standardized plan designs [5] with premiums ranging from $50 per month to several hundred dollars.

Lots of Money Suckers At Play

As complex and baffling as all this may be, it is just about enrollment and benefit design. Far more problematic is the endless tinkering with how to pay for the promised benefits. Providers who deliver services to Medicare patients have been constantly whipsawed back and forth with different payment methods and cost containment efforts. Just some of the payment reforms have included:

- The whole “participating provider” system [6], including various ways of non-participation and limits on allowable billing.

- Diagnostic Related Groups [7] (DRGs) for hospital payments, first introduced in the 1980s and constantly revised and expanded since then.

- Resource-Based Relative Value Scale [8] (RBRVS), introduced for [9] physician payment in 1992.

- An entire series of demonstration projects, including Disease Management, Care Coordination, Pay for Performance, and Value Based Purchasing, none of which have actually worked.

- More recently, the HITECH Act, which was part of President Obama’s stimulus legislation in 2009. This mandate to use federally standardized electronic medical records was not confined to Medicare, but had a profound effect on decreasing the efficiency of providers [10] in the program.

- Accountable Care Organizations (ACOs), one of the primary Medicare reforms built into the Affordable Care Act and already failing [11].

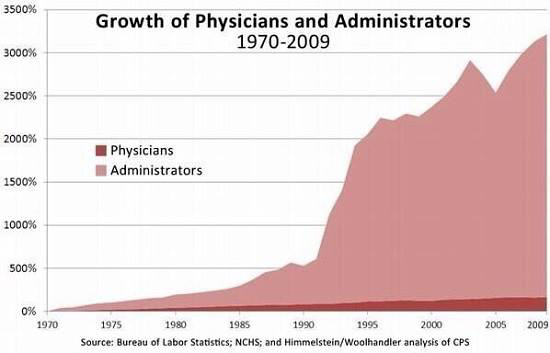

None of these efforts has worked, but they have all added substantially to administrative costs as physicians and hospitals have to run out to hire new attorneys, accountants, software engineers, and compliance officers every time Washington comes up with a nifty new idea to police provider behavior. And none of these new costs add anything to actual patient care.

Consumer-Driven Health Care: A Better Way

Read the entire report by Greg Scandlen: http://thefederalist.com/2017/08/03/take-medicare-mess-modern/#disqus_thread [12]

Also read a brief Bio of Greg in section 16 below:

Feedback . . . [13]

Subscribe MedicalTuesday . . . [14]

Subscribe HealthPlanUSA . . . [15]

Government is not the solution to our problems, government is the problem.

– Ronald Reagan